Dry goods | One article to understand the supply chain finan

2020-09-17 09:47

The characteristics of supply chain finance:

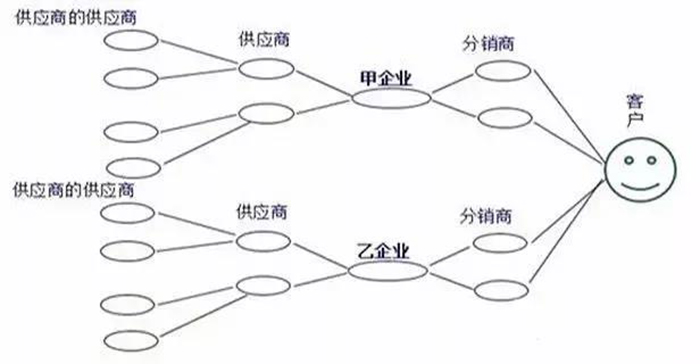

The supply chain is through the control of information flow, logistics, and capital flow, starting with the purchase of raw materials, making intermediate products and final products, and

finally delivering the products to consumers through the sales network , bringing suppliers, manufacturers, and distributors , retailers, and end users are connected into a

whole functional network chain structure.

It is not only a supplier connected to the user's logistics chain, information chain, the capital chain, and is an increase in the value chain, materials supply chain in

the process due to processing, packaging, transportation and increase its value to the relevant business revenue .

Generally speaking, the supply chain of a particular product starts from the procurement of raw materials, to the production of intermediate and final products, and finally the

products are delivered to consumers by the sales network , from suppliers, manufacturers, distributors, retailers, and the end users. Connected as a whole.

In this supply chain, core companies with strong competitiveness and large scale often

impose severe demands on upstream and downstream supporting companies in terms of delivery, price, and billing terms due to their strong positions. pressure.

The upstream and downstream supporting enterprises are mostly small and medium-sized enterprises, and it is difficult to obtain financing from banks. As a result, the capital chain is very tight and the

entire supply chain is out of balance.

The biggest feature of "supply chain finance" is to find a large core enterprise in the supply chain, and take the core enterprise as the starting point

to provide financial support for the supply chain.

On the one hand, it will effectively inject funds into relatively disadvantaged upstream and downstream supporting SMEs to solve the problems of SMEs’ financing difficulties and supply chain imbalances

.

On the other hand, integrating bank credit into the buying and selling behavior of upstream and downstream enterprises, enhancing their commercial credit, promoting SMEs and core enterprises to

establish long-term strategic synergies, and enhancing the competitiveness of the supply chain.

Under the financing model of "supply chain finance", once an enterprise in the supply chain obtains the support of the bank, the "cord blood" of funds is

injected into the supporting enterprise, which

is equivalent to entering the supply chain, which can activate the entire "chain" operation; and with the support of bank credit, but also for

small and medium enterprises to win more business opportunities.

Supply chain finance originated from traditional banks. However, under the impact of Internet technology, the threshold of finance has also been lowered. Internet finance has

provided the market with more choices.

Under the supply chain finance model, for core companies, related companies in the supply chain can still share capital risks for them.

For the upstream and downstream enterprises of the core enterprise, with the credit support of the core enterprise, the loan line can be smoothly obtained at a lower cost.

For P2P and other capital suppliers, through cooperation with core large enterprises, they can master the complete capital flow, logistics and information flow in the supply chain and

other core data, so as to transform the uncontrollable risks of a single enterprise into the overall controllable supply chain Risk, so as to control the risk more effectively

Disclaimer: Some pictures are from the network. If the copyright owner has objections, please contact to delete!