2019 seems to be a curse.

From the beginning of the year to the end of the year, a series of negative topics such as layoffs, domestic violence, cold winter, bankruptcy, running away, thunder... etc. have never stopped.

Even the "eating soup" that used to raise hundreds of millions of yuan is inevitable. The company has failed in financing and has closed down.

There is almost no sign. It claims to have sold 4 million copies of Internet celebrity soup in a year.

Eat a soup suddenly closed all stores in Shenzhen, and the headquarters was already empty.

The reporter visited Chiatangmen shop in Longhua District, Shenzhen, and found that the shop was closed. There was an A4 paper posted on the door. The

header read: Chigetang company has been cancelled and the store has closed down. Please join the group to protect the rights of recharge.

For the death of eating soup, the explanation given by the founder Zhan Chufeng is "funding fracture". In this regard, the reporter contacted a number of investors who had a soup, and

they all expressed inconvenience to discuss the matter. A partner of a VC agency who had been in contact with the project in the early stage guessed that

“the stall is too big and the expected financing is not in place”.

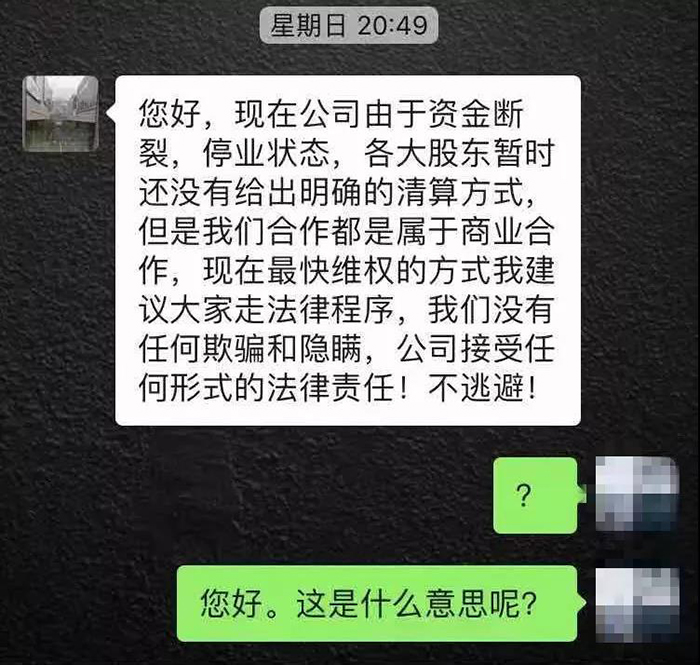

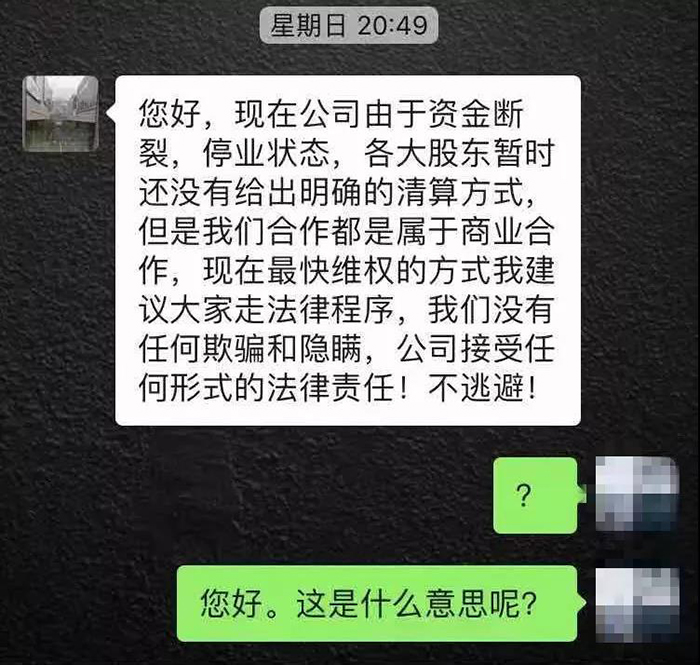

Chat history between supplier and founder Zhan Chufeng

However, things are much more than that. A VC investor bluntly said that if the VC's money is lost due to poor management,

it is not a big problem. However, behind the closing of the restaurant, nearly 300 employees were still in arrears of wages, and

dozens of suppliers failed to settle the payment of nearly tens of millions of dollars; the most deadly thing was that the

millions of funds invested by dozens of "associates" were missing. The report has been reported. With 4 million copies sold in one year, this star restaurant company died suddenly.

Sudden death after eating soup is just a microcosm of venture capital's cold winter.

The failure of financing seems to be the last straw to be crushed. "Because of our poor management, the

company has made bumpy progress in capital market financing this year. The funds negotiated many times have not arrived on time. The

company's capital chain has broken, which has led to the company's long-term suspension of business."

Starting a business is not easy! Once it fails, there is only a sigh of glory in the past.

Many companies are in trouble

No matter how glorious you have been, a little slack will end in tragedy.

A few days ago, Guirenniao failed in the capital market due to debt problems, and it was revealed that its equity was auctioned,

500 million bonds defaulted, the market value shrank by 93%, the assets were continuously sold, and more than 2,000 stores were closed.

From the peak to the trough, the nobleman bird only took five years.

The 2008 Beijing Olympics set off a "sports fever", and Guirenniao just caught up with the dividends of the sports industry.

Noble Bird stores expanded rapidly, from 1,847 to 5,067, and

operating income soared from 600 million yuan to 2.649 billion yuan. In January 2014, Guirenniao was listed on the Shanghai Stock Exchange.

As soon as it went public, the market value surpassed Xtep and 361 degrees, which

had been listed on the Hong Kong stocks for many years, and at one time exceeded 40 billion. It was named "A-share sports No. 1".

Guirenniao official website

But the listing did not bring good luck to the precious bird.

Since 2015, Guirenniao has frequently invested in mergers and acquisitions.

Investing in Hupu Sports became the second largest shareholder of the latter. The

two parties also cooperated with Jinglin Capital to establish a sports industry investment fund-Dynamic Capital;

invested nearly 200 million yuan in Kangpais Sports;

invested 200 million yuan to establish with Hupu Sports The second phase of sports industry fund competition domain; Jiezhixing and Mingshoe Warehouse

were controlled

by 383.1 million yuan and 382.5 million yuan respectively; Xiangan Insurance was invested with 15.105 million yuan, and it was planned to invest 260 million yuan to jointly establish Ankang Insurance;

with 2,603.72 million yuan. Acquired the license of AND1 brand in China for USD 10,000;

Acquired the remaining 49% of Mingxuecu for RMB 367.5 million;

Purchased 45.45% of Hubei Shengdao Sports for RMB 150 million;

Acquired the use of PRINCE in China and South Korea for EUR 20 million right;

This year, Guirenniao even wanted to change its name to "Almighty Sports."Such a stunning territory looks beautiful on the surface, but in fact the noble bird in private is exhausted.

Such crazy investment mergers and acquisitions not only failed to bring the expected performance growth to Guirenniao, on the contrary, Guirenniao added considerable financial pressure.

In 2018, Guirenniao began to deal with assets.

Nowadays, the noble bird is not the noble person, the rich bird is not rich, the Annunciation bird does not announce the good news, and the peace bird is not peaceful. Everything is changing too fast now. It is very likely that the fisherman who went smoothly yesterday will not be able to catch fish today.

The former video and audio overlord Storm Group is a living example.

In March 2015, Baofeng Group was officially listed, known as the "king of magic stocks", with a market value of more than 40 billion yuan.

The stockholders at the time would not have expected that the once "demon stock" would fall into such a dilemma. This storm group, once favored by Ali, developed quite smoothly in the "first half of his life", but now it has a dead end.

At present, the business of Baofeng Group is at a standstill and faces the risk of no source of business income.

Moreover, CEO Feng Xin was arrested and executives left one after another. There are only more than 10 employees in the company, and some employees are still in payment.

In the past two years, the domestic economic growth rate has slowed down, and there are probably countless companies struggling to close down... Cash flow is the blood of an enterprise! Recently, Dong Huajun has received many

messages from the bosses of small, medium and micro enterprises-the speed of corporate capital turnover is slow, and financing is becoming more and more difficult... Financing difficulties and expensive financing have plagued small and medium-sized enterprises for many years. Although banks have money, they prudently borrow and cherish loans.

Enterprises want to develop but are constrained by lack of money. In the recent period, the market’s liquidity has been significantly tightened. The accounts receivable of some companies have soared, and

some capital withdrawal rates are even less than 40% of the annual sales income. Came into being.

In the factoring business, financial services or products that finance companies and provide other related services through the acquisition of corporate accounts receivable. The

specific operation is that the factoring company (a supply chain company with factoring qualifications) buys from a supplier or seller Into

the accounts receivable to the debtor or the buyer, usually in the form of invoices , and provide debt collection,

sales account management and bad debt guarantees according to customer needs .

Accounts receivable financing can obtain advance payment financing after the exporter ships the goods, so as to quickly recover the payment, and

always maintain sufficient working capital for continuous ordering. It can realize sales collection in advance, accelerate the flow of funds, and

generally does not require other pledges and guarantees, reducing the financial pressure on both parties.

Donghua Supply Chain has rich experience in the factoring business of accounts receivable financing. There have been many successful cases so far, which

can effectively solve the financing problems of exporters. If your company also has export financing needs,

please contact Us: 0769-22898086 In enterprise development, sometimes the concept is one step ahead, and the development can achieve a leapfrog upgrade. Disclaimer: Some pictures are from the network. If the copyright owner has objections, please contact to delete!