International export factoring

2021-03-08 09:07

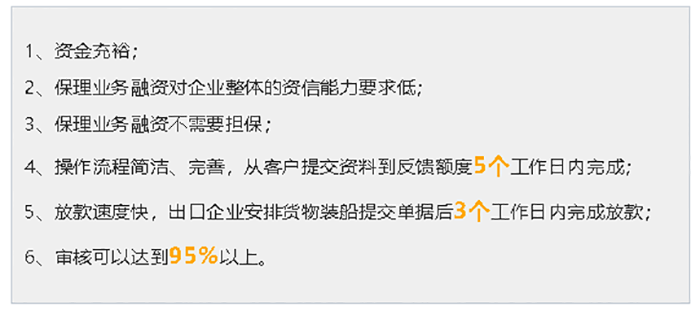

(1) Information financing

Generally speaking, SME customers have a relatively weak position in transactions with customers or in the supply chain. Usually, they must provide credit settlement conditions for sales. Accounts receivable. Factoring can help them revitalize their accounts receivable. Fund assets to promote effective use of funds

(2) Increase sales and profits

Although the method of credit sales has formed accounts receivable, it is a common means of competition to promote sales and expand the market. When goods or services are sold, profits are formed. Credit sales lead to high financial pressure. Factoring can help.

(3) Sales sub-account management

Factors can regularly provide accounts receivable collection status, overdue accounts status, aging analysis, etc., according to customer requirements , and send various statements to assist customers in sales management

(4) Improve financial structure

Factoring business does not need to borrow from financial institutions, will not increase the debt ratio and increase the currency assets, reduce the accounts receivable, and optimize the entire financial structure

(5) Reduce exchange rate risk

Import and export business will face the risk of exchange rate changes. By handling export factoring prepaid financing, foreign exchange collection can be realized in advance and the exchange rate risk can be locked in

(6) Bad debt guarantee

The factoring company can verify the buyer's risk limit according to the actual situation, and provide 100% guarantee for the seller 's accounts receivable caused by the delivery or provision of labor within the limit.

(7) Collection of accounts receivable

The factoring company has a professional collection team that will take reasonable, powerful, and disciplined methods according to the overdue time to help customers safely and quickly recover the accounts

(8) Increase in buyer credit investigation

Paul Factoring in operation before factoring business will be relatively buyer credit assessment of the buyer to assess the results back to the seller no doubt for the seller's sales decisions provide a strong basis for judgment